The post Why Crypto and Stocks Are Crashing: $5.5T Wipeout Explained! appeared first on Coinpedia Fintech News

Over the past month, the S&P 500 has dropped by 7.13%, while the cryptocurrency market has fallen by 17.09%. Many believe this decline is due to US President Donald Trump

Donald Trump

Donald Trump is an American former president politician, businessman, and media personality, who served as the 45th president of the U.S. between 2017 to 2021. Trump earned a Bachelor of science in economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential election as the Republican Party nominee against Democratic Party nominee Hillary Clinton while losing the popular vote. As president, Trump ordered a travel ban on citizens from several Muslim-majority countries, diverted military funding toward building a wall on the U.S.–Mexico border, and implemented a family separation policy. Trump has remained a prominent figure in the Republican Party and is considered a likely candidate for the 2024 presidential election

President

’s decision to impose tariffs on China, Canada, and Mexico. But is that really the full story?

Donald Trump

Donald Trump is an American former president politician, businessman, and media personality, who served as the 45th president of the U.S. between 2017 to 2021. Trump earned a Bachelor of science in economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential election as the Republican Party nominee against Democratic Party nominee Hillary Clinton while losing the popular vote. As president, Trump ordered a travel ban on citizens from several Muslim-majority countries, diverted military funding toward building a wall on the U.S.–Mexico border, and implemented a family separation policy. Trump has remained a prominent figure in the Republican Party and is considered a likely candidate for the 2024 presidential election

President

’s decision to impose tariffs on China, Canada, and Mexico. But is that really the full story?

A deeper analysis suggests something bigger is at play—something that has erased trillions of dollars from the markets in just weeks. The Kobeissi Letter points to a major shift in sentiment that may be driving this downturn more than any policy decision.

Could fear, not fundamentals, be the real reason behind the sell-off? Let’s break it down.

$5.5 Trillion in Market Value Wiped Out

On January 10, the total crypto market cap stood at $3.23 trillion, while the S&P 500 index was at 5,828.54. Since then, the crypto market has fallen by 20.12%, and the S&P 500 has declined by 3.67%.

The Kobeissi Letter reports that in just the past two months, both markets have lost a combined $5.5 trillion. Most of these losses came after February 20, with the S&P 500 alone shedding $4.5 trillion in market value.

On February 20, the S&P 500 was trading at 6,133.58. Since then, it has dropped by 8.46%. The crypto market has fallen even further, down 18.86% during the same period.

Trade War Is Just a Scapegoat

While concerns over a trade war were already known, analysts argue that the sudden shift in market sentiment has played a bigger role in this sell-off.

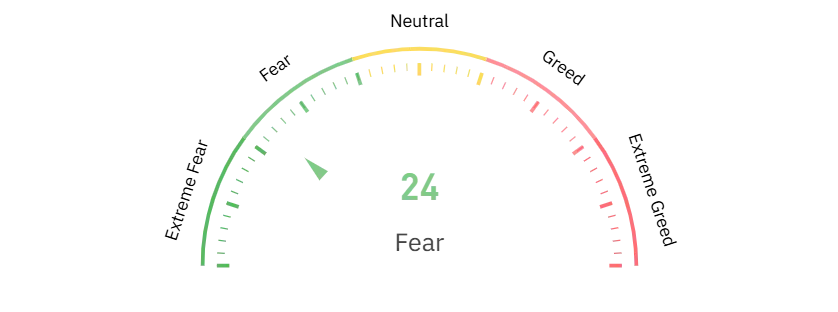

Investor sentiment has taken a sharp turn. The Crypto Fear & Greed Index, which measures market sentiment, now stands at 24—far below the 82 recorded a year ago. On November 22, 2024, the index peaked at 94, but by February 27, it had plunged to just 10.

This dramatic shift from extreme greed to extreme fear has fueled the sell-off, according to market experts.

Hedge Funds Reduce Exposure, Ethereum Gets Shorted

Hedge funds had already been reducing their exposure to tech stocks, hitting a 22-month low before the recent market drop. Year-to-date returns for major tech stocks show steep losses:

- Apple (AAPL): -4.85%

- Microsoft (MSFT): -9.81%

- Nvidia (NVDA): -20.34%

- Broadcom (AVGO): -20.44%

- Oracle (ORCL): -10.71%

At the same time, reports suggest institutional investors shorted Ethereum on February 9, just before the crypto market crash. On that day, ETH was trading at $2,624.48. Since then, it has fallen by 28%, including an 8.1% drop in just the last 24 hours.

What’s Next? More Volatility Ahead

Another sign of market stress is the VIX index, which tracks volatility. It has surged by 70% over the past month, indicating that uncertainty remains high.

For now, the market decline seems to be driven more by fear than by actual economic fundamentals. Traders watching shifts in sentiment could have an advantage in navigating these price swings. With volatility at extreme levels, more big moves are likely in the days ahead.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Crypto prices are falling due to market fear, institutional sell-offs, and a shift in sentiment, triggering widespread liquidations.

Hedge funds reduced tech stock exposure, and reports indicate institutions shorted Ethereum before the crypto market’s major decline.

0 Comments